How to Open a U.S. Business Bank Account Without Traveling to America

In this blog post, I'll share my personal experiences, tips, and recommendations for setting up a U.S. bank account from abroad.

As someone who has navigated the complexities of setting up a U.S. business bank account remotely, I know firsthand how challenging—and rewarding—it can be. If you're running an international SaaS project, freelancing business, or any venture that requires receiving payments in USD, having a U.S. bank account is almost essential. Thankfully, it's now easier than ever to open an account without physically traveling to the U.S., thanks to modern fintech solutions like Mercury, Wise, and others.

Why Open a U.S. Business Bank Account?

Having a U.S. business bank account offers several advantages:

Seamless Payment Processing: Many platforms like Stripe, PayPal, and marketplaces prefer U.S. bank accounts for smoother transactions.

Professional Credibility: A U.S. bank account adds legitimacy to your business, especially if you work with American clients or partners.

Avoiding High Conversion Fees: Receiving payments in USD directly can save you from excessive currency conversion fees.

What You Need Before Getting Started

To open a U.S. business bank account remotely, you'll need the following:

EIN (Employer Identification Number): This is essential for any U.S.-registered business. If you don’t already have one, you can apply for it through the IRS website.

U.S. Business Address: A virtual mailbox service like US Global Mail or PostScan Mail can provide this for you.

Company Incorporation Documents: If your business is incorporated in the U.S., you'll need to provide proof.

Government-Issued ID: A valid passport or local government-issued ID is typically required.

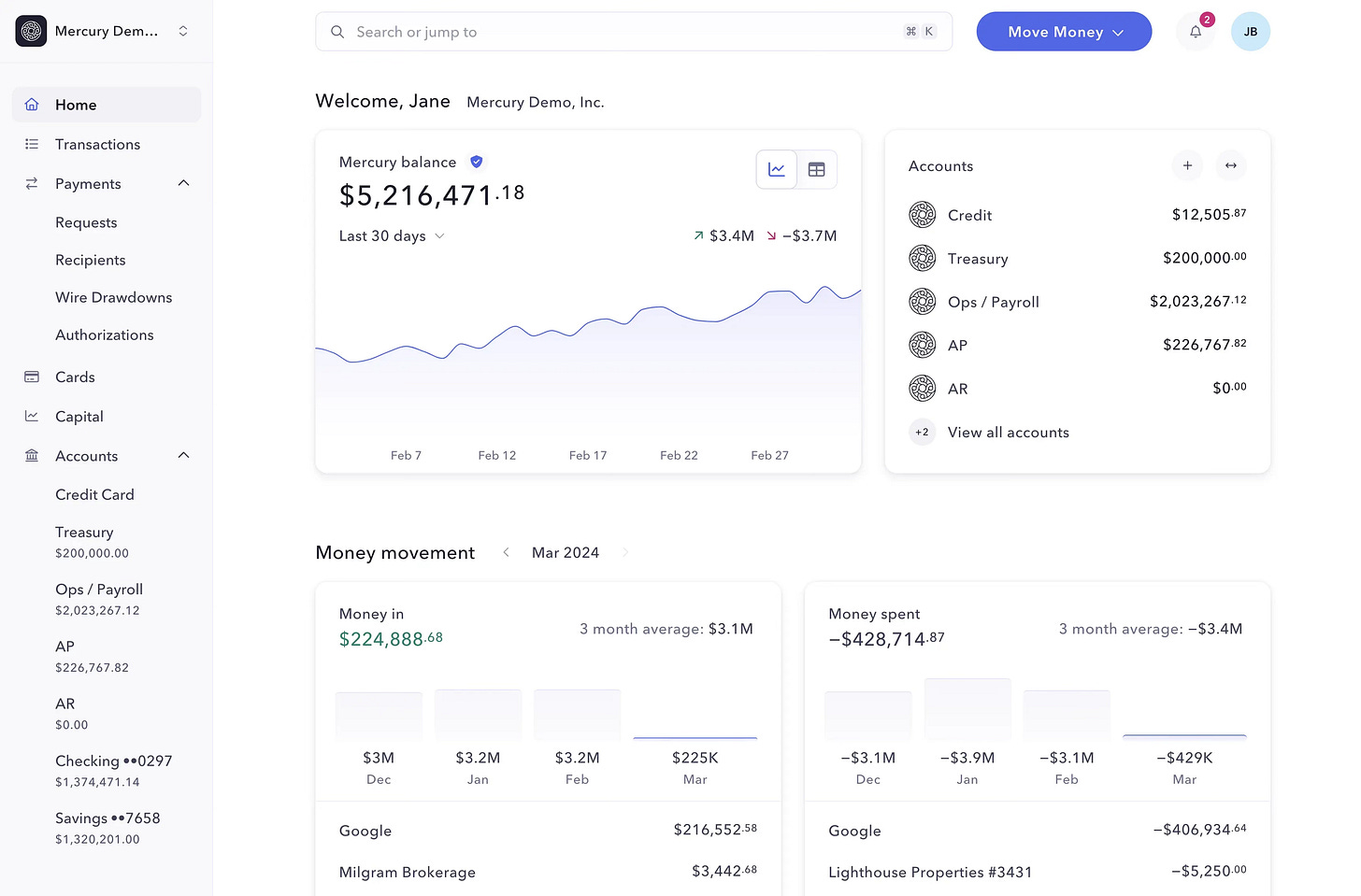

Mercury: My Go-To Solution

One of the best tools for opening a U.S. bank account remotely is Mercury. From my experience, Mercury offers a smooth onboarding process, minimal fees, and excellent functionality.

Key Features of Mercury:

Remote Application: No need to visit the U.S. Mercury is fully digital and caters specifically to non-U.S. residents.

Debit Cards: Mercury allows you to request both virtual and physical cards. Even if you're abroad, they'll ship the physical card to your address.

Integration with Stripe: If you're running a SaaS project or need to handle recurring payments, Mercury integrates seamlessly with Stripe.

Invoicing Feature: Recently, Mercury added an invoicing feature. This allows you to create, send, and track invoices directly from your account, making it an all-in-one solution for entrepreneurs.

Support Me by Using My Referral Link

If you're ready to give Mercury a try, you can support me by using my referral link:

Mercury Referral Link

By signing up through my link, you'll help me out while setting up your U.S. business bank account with this fantastic platform.

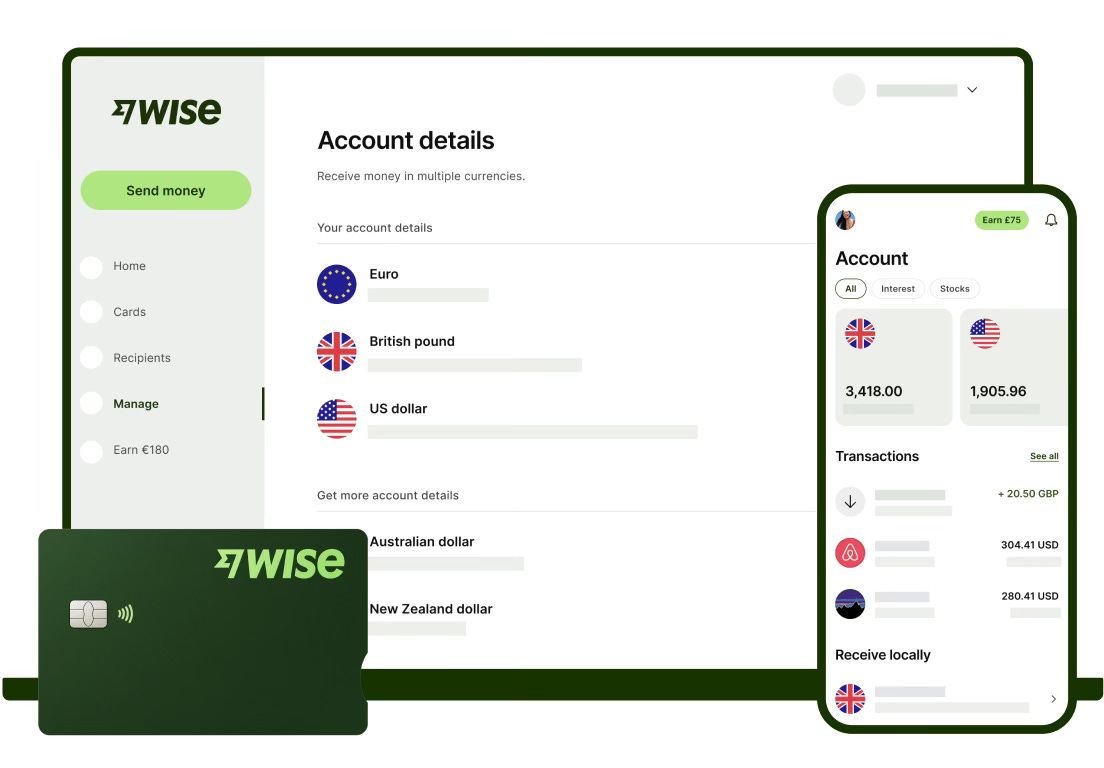

Wise (Formerly TransferWise)

If you're looking for another great option, Wise might be your answer. Wise allows you to create a U.S. bank account equivalent, complete with routing and account numbers. It’s perfect for freelancers or small businesses that need a straightforward solution.

Key Features of Wise:

Multi-Currency Accounts: Wise lets you hold and manage funds in multiple currencies.

Low Transfer Fees: Wise is renowned for its transparent and low-cost currency conversion rates.

Ease of Use: Setting up a Wise account is quick, and the interface is very user-friendly.

Support Me by Using My Referral Link

Interested in using Wise? Sign up through my referral link:

Wise Referral Link

Other Bank Options

While Mercury and Wise are my top picks, there are other fintech solutions worth exploring:

Brex: Geared toward startups, Brex offers accounts with no fees and excellent integrations with business tools. However, Brex has stricter eligibility requirements.

Relay: Another great choice for businesses looking for multiple user access and detailed cash flow tracking.

Silicon Valley Bank (SVB): Known for catering to tech startups, SVB offers more traditional banking features, but their application process might be more complex for non-U.S. residents.

Benefits of Going Remote

Setting up a U.S. bank account remotely comes with many benefits:

Save Time and Money: No need to travel to the U.S., saving you significant expenses.

Global Accessibility: Modern digital banks like Mercury and Wise make it easy to manage your account from anywhere.

Scalability: These accounts are built to support the growth of your business, whether you're a freelancer or managing a global SaaS platform.

Pro Tip: Streamline the Process

To make the setup process smoother:

Incorporate your business in a U.S. state known for being business-friendly, like Delaware or Wyoming.

Use services like Stripe Atlas to handle incorporation and bank account setup simultaneously.

Keep all your documents organized and ready to upload during the application process.

Final Thoughts

Opening a U.S. business bank account without stepping foot in America is no longer a far-fetched dream. Thanks to solutions like Mercury, Wise, and others, entrepreneurs worldwide can now access the benefits of U.S. banking with just a few clicks. Personally, I’ve found Mercury to be an incredible tool, especially with its invoicing feature and integration with Stripe. For simpler needs, Wise is an excellent alternative.

If you're looking to take your international business to the next level, don’t let borders stop you—these tools are here to help! And if you found this guide helpful, feel free to use my referral links for Mercury and Wise to get started today.

Let’s make global banking simpler together!